GoodLabs Fraud Prevention ENGINEERING

Trusted by Fortune 500 Financial Institutions.

can’Tkeep pace with emerging attacks?

With 2.5 million daily dark web visitors innovating fraudulent methods, you face a growing challenge in staying abreast of these sophisticated threats.

Your fraud system hinders timely response?

Fraud systems can take days or weeks to detect fraud, allowing culprits to advance or cover tracks.

Millions of fraudsters dwarfs your fraud team?

Facing millions of fraudsters, financial institutions with fraud teams averaging in the mere hundreds.

We are crime fighters

GoodLabs Financial Crime Studio is a leader in the fight against financial crime, spearheaded by a team with unmatched expertise in the field. Our team is led by Hussain Jaber, our Director of Financial Crime and a seasoned defender in the industry; Matthew O’Neill, Special Financial Crime Advisor and former Deputy-in-Charge of Cybercrime at the US Secret Service; and Hieu Ngo, Dark Web Advisor, whose past as a reformed fraudster provides the most up-to-date attack vectors deep from the dark web.

Well-respected by leading fraud technology vendors

GoodLabs stands at the forefront of this transformative journey. We specialize in modernizing fraud systems using state-of-the-art solutions, including biometrics intelligence and graph and streaming analytics platforms. Our fraud engineering practice equips our clients with the most robust and resilient fraud defence mechanism that stands the test of time.

trusted by fortune 500s

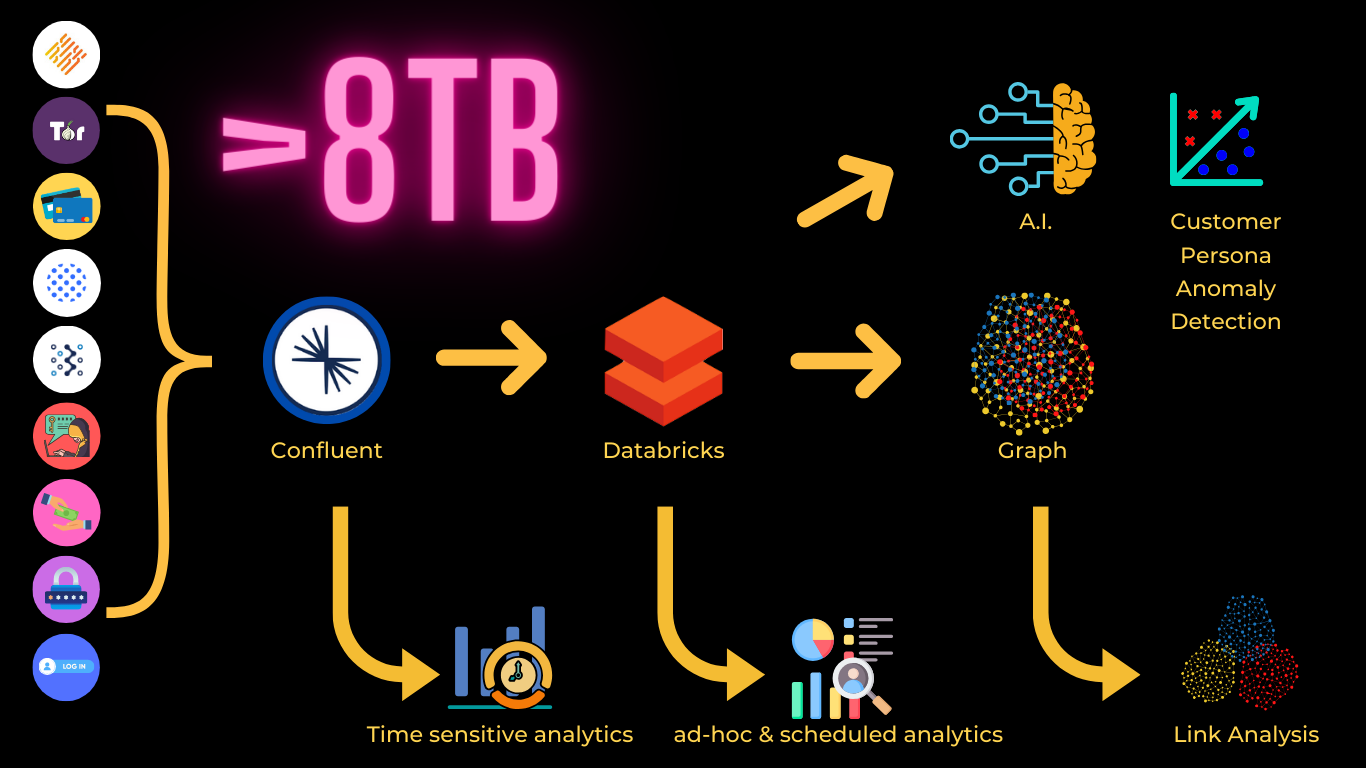

GoodLabs, trusted by Fortune 500 financial institutions, shines in advancing fraud systems to manage massive amounts of near real-time daily fraud data using best-of-breed design. Our architecture integrates a myriad of discrete data sources, including TOR exit IP addresses, customer biometrics and day-to-day transactions, to provide real-time analytics for rapid responses in latency-sensitive environments like payments. Using graph analytics and streaming datalakes, your future-proof systems enable your fraud teams to swiftly uncover and address complex fraudulent networks in minutes, not weeks. Additionally, GoodLabs can further enhance your defences by training your deep learning models to efficiently counter the tactics of millions of potential fraudsters efficiently.

expert in anti-money laundering

In the face of stringent compliance and regulatory requirements, with severe penalties for non-compliance in anti-money laundering (AML) practices, financial institutions face significant challenges. Our expertise in leveraging advanced technologies, including graph analytics and neural networks, offers a powerful solution. We specialize in scaling AML investigations and streamlining report filings, enabling financial institutions to handle the increasing pressures of compliance and regulatory demands effectively. By integrating these sophisticated technologies, we help ensure that institutions can meet their obligations more efficiently and accurately, reducing the risk of penalties and enhancing overall compliance posture.

A.I. Powered Fraud Defence

At GoodLabs, we pride ourselves on pioneering solutions at the forefront of A.I. technology to combat fraud in the financial sector. Our multidisciplinary approach involves close collaboration between domain experts in fraud detection, a dedicated A.I. research team comprising Ph.D. and postdoctoral scholars, and our skilled software engineering team. Together, we harness cutting-edge A.I. models to address complex challenges, such as cheque fraud and voice vishing detection. By leveraging advanced technologies and expertise, we empower financial institutions to scale their fraud-hunting efforts effectively, safeguard assets, and maintain trust in the digital financial landscape.

Let’s fight crime together!

Our Financial Crime Studio domain experts and engineers can fortify and modernize your fraud operations against ever-evolving financial threats.